Gwendolyn Wu

Executive Content Editor

When September rolls around, many University of California, Santa Barbara students scramble to get their paperwork in order before the school year starts. Verifying and waiving health insurance are part of that to-do list for some, but those doing that this year have a new option to examine: the Gaucho Access Plan (GAP).

Student Health Services introduced the plan in March, noting in an email to all students that financial aid awards could cover the charge and allowing students to enroll beginning spring 2016. It will be fully implemented this fall, but students have run into problems understanding enrollment criteria and waiving prepaid access.

GAP costs users $465 a year and lets students see primary care physicians and specialists (e.g. dermatologists, gynecologists, etc.). In-house lab tests and medical advice at Student Health are also included in the GAP. It costs over $2,500 less than the all-encompassing Gaucho Health Insurance, which includes other services like prescriptions. Students who don’t want to pay the premium for Student Health must seek healthcare outside of campus.

“We wanted to keep the price of GAP reasonable, so we couldn’t include pharmacy, physical therapy and the Eye Care Center or Dental Care Center where costs are not always controllable,” Mary Ferris, the executive director of Student Health, wrote in an email to The Bottom Line. “Those charges should be covered by a student’s outside insurance plans.”

On social media, students asked questions about the process, such as who qualified for the Aetna-affiliated plans. For instance, most Kaiser Permanente and CenCal Health users did not receive notifications to enroll, but general Medi-Cal users did.

Ferris clarified why some students were required to purchase GAP to fulfill enrollment requirements. Any health insurance plan that covers urgent medical needs within a 50-mile radius of the university is eligible to be waived under UC policy, but plans that meet the bare minimum leave holes by not covering physician care and paying for extras like medication and tests.

“These plans may technically meet the UC health insurance minimum criteria and are thus approved for waivers, but leave our students with very inadequate coverage which has often resulted in huge financial burdens when illness or injury strikes,” Ferris wrote. “Rather than deny their waivers, we are allowing them to keep those plans but mandating they purchase GAP so that at least they can use Student Health when they are sick while at UCSB.”

Third year computer engineering major Clara Frausto feels that it’s a “step in the right direction.” Although she worries about using insurance to cover the cost of prescriptions and services GAP excludes, it feels like a cost-effective way to get the health care she needs.

“While I don’t get all the benefits of GHI, GAP is significantly cheaper, and I feel safer knowing I can easily walk into student health for most kinds of check ups,” Frausto wrote in an email to The Bottom Line. “It’s very important to me that I am in walking distance of a health centre [sic] I can go to since I have no car and I get sick easily.”

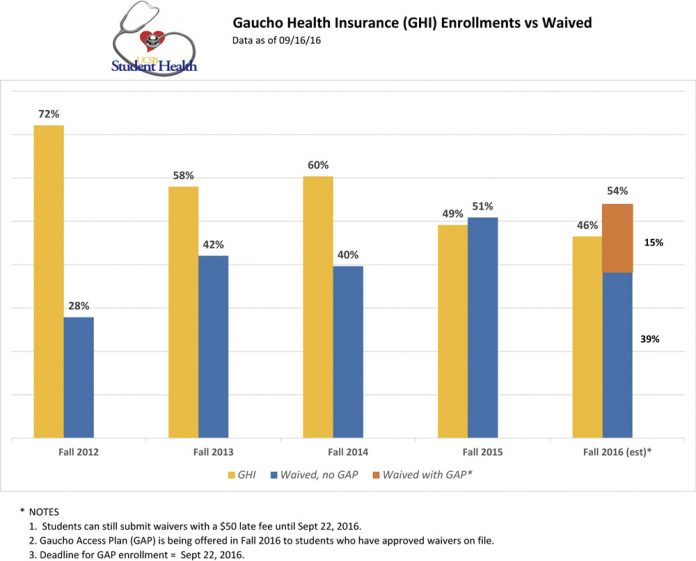

Waiving health insurance can be tricky for many UCSB students, including incoming freshmen, but it’s become especially popular in recent years. According to data from Student Health, the demand to waive GHI spiked in 2012 (due to the passage of the Affordable Care Act) and has been high since. Of approximately 23,500 undergraduate and graduate students enrolled in 2015, nearly 12,000 had waived GHI.

While university enrollment numbers won’t be complete until the school takes a census in October, Student Health has been tracking GAP enrollment. As of Friday, Student Health estimated that 15 percent of students had enrolled in GAP, suggesting that thousands of students are still eligible to waive both health plans.

First-year biology major Keith Nguyen is one of those students working to waive GAP for financial reasons. When Nguyen applied to waive GAP, he had to change his Medi-Cal county coverage to Santa Barbara, but was unable to do so until he had a physical address. Room assignments came out in early September, leaving a short window of time to let change-of-address paperwork process.

“I honestly think the idea of GAP is a convenient program for students who live on campus. However, the process of waiving it proves to be difficult,” Nguyen said. “Note that GAP waiver deadline is Sep. 22, so I am currently on a time crunch to waive that $155 per quarter. I think it is very inconvenient for the school to put deadlines so close together.”

While there has been limited experience with the effectiveness of GAP in providing for students who fall through the cracks in receiving primary care, students and staff are hopeful that it will alleviate worries about paying for medical visits. However, even with the drastically reduced cost, students are turning away in favor of saving money if they are able to get it waived.

“[I’m trying] to save up as much as possible during my years in undergrad so that I do not end up with a lot of student debt after graduation,” Nguyen said. “[With] the $155 per quarter for GAP, I can buy books, supplies for school, or even personal expenses. College is just simply expensive.”